Bookkeeping

Present Value PV: Definition, Formula & Calculation

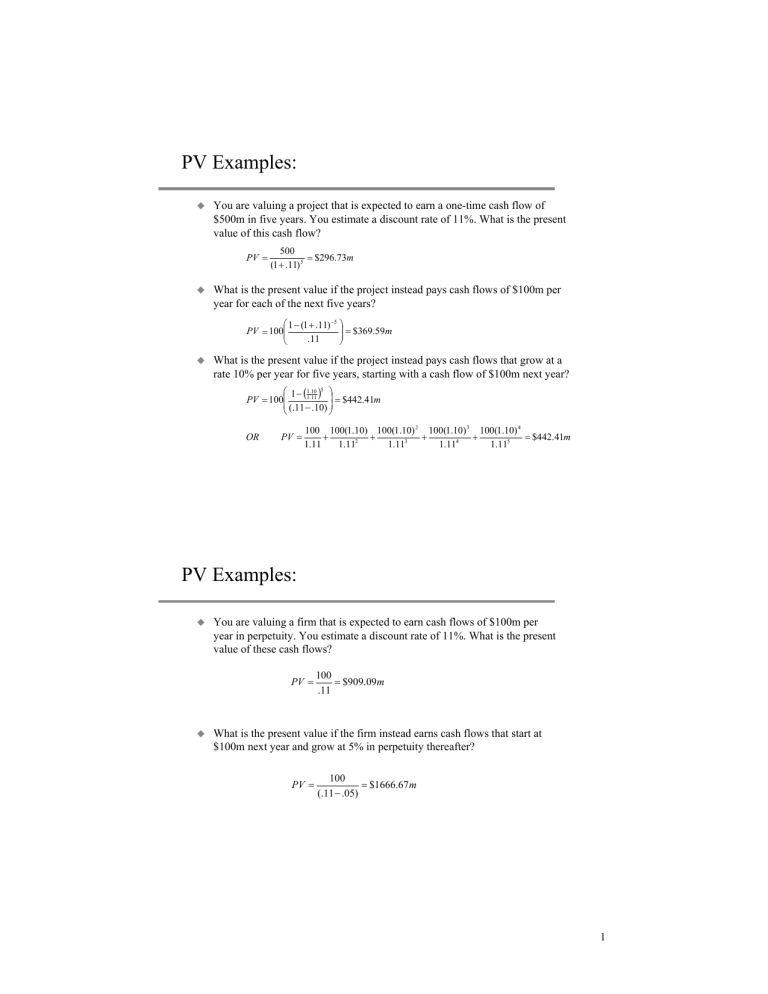

Much more on “discounting” further down, but we do also have a separate article on discounting future cash flows if you’re interested. As we can see in the above example, time can make a big difference as to how much money invested today can grow over time. Assume an investment of money with a known annual discount rate in the form of an interest rate on a bank deposit, hence annual periodicity, and known (or estimated) future value of $100,000. What is the present value of this investment if it is expected to receive this future value of $100,000 in 1, 2, 3, 5, or 10 years from now?

Calculating Future Value vs. Present Value

This is a simple online software which is a good starting point in estimating the Present Value for any investment, but is by no means the end of such a process. You should always consult a qualified professional when making important financial decisions and long-term agreements, such as long-term bank deposits. Use the information provided by the tool critically and at your own risk. This factor includes the given interest and periods and can now be multiplied by any amount of money to find the cooresponding present value. You can then look up PV in the table and use this present value factor to calculate the present value of an investment amount. You can think of present value as the amount you need to save now to have a certain amount of money in the future.

Want to get past your fear of financial math?

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

- It’s called the Rule of 72, which tells you the number of years it takes for your money to double at a given annual rate of return.

- Starting off, the cash flow in Year 1 is $1,000, and the growth rate assumptions are shown below, along with the forecasted amounts.

- Moreover, the size of the discount applied is contingent on the opportunity cost of capital (i.e. comparison to other investments with similar risk/return profiles).

The Present Value Calculator is an excellent tool to help you make investment decisions. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators social security 2021 for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

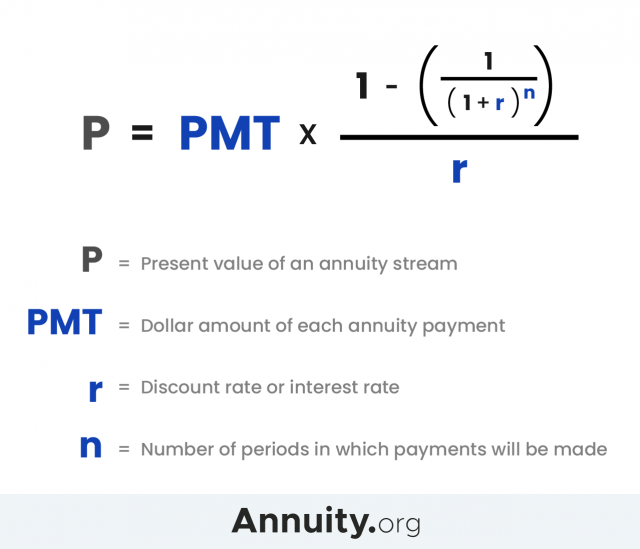

Present Value Formula and Calculation

Annuity denotes a series of equal payments or receipts, which we have to pay at even intervals, for example, rental payments or loans. The present value of a single amount is an investment that will be worth a specific sum in the future. For example, if you invest $1,000 today at an interest rate of 12%, it’ll be worth $2,000 in 5 years. For example, suppose you want to know what interest rate (compounded semi-annually) you need to earn in order to accumulate $10,000 at the end of 3 years, with an investment of $7,049.60 today. This is equivalent to saying that at a 12% interest rate compounded annually, it does not matter whether you receive $8,511.40 today or $15,000 at the end of 5 years. Present value is a quick and easy way to get a good idea of the value of a sum of money or cash flow.

The sum of all the discounted FCFs amounts to $4,800, which is how much this five-year stream of cash flows is worth today. Present Value, or PV, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. Let us take another example of a project having a life of 5 years with the following cash flow. Determine the present value of all the cash flows if the relevant discount rate is 6%. That means if I want to receive $1000 in the 5th year of investment, that would require a certain amount of money in the present, which I have to invest with a specific rate of return (r). Present value calculations are tied closely to other formulas, such as the present value of annuity.

Example: You can get 10% interest on your money.

Future value is the total sum of money that will accrue over time when that initial sum is invested. In the case of not having a consistent rate, it wouldn’t be so easy to calculate the present value. For example, if you were to invest in a company, the assumed rate of return could end up changing in each of the following three years.

However, the ease comes at the cost of accuracy which can lessen the financial benefits. Any asset that pays interest, such as a bond, annuity, lease, or real estate, will be priced using its net present value. Stocks are also often priced based on the present value of their future profits or dividend streams using discounted cash flow (DCF) analysis.

The concept is that a dollar today is not worth the same amount as a dollar tomorrow. The net present value calculates your preference for money today over money in the future because inflation decreases your purchasing power over time. When you start working with time value of money problems, you need to pay attention to distinguish between present value and future value problems. One way to solve present value problems is to apply the general formula we developed for the future value of a single amount problems. Another way of looking at this is to say that because of the time value of money, you would take an amount less than $12,000 if you could receive it today, instead of $12,000 in 2years. Whereas if the discount rate is higher, then the present value will be lower.

Because the cash flows are discounted or decreased by the amount of interest growth you could receive if you had all the cash today and invested it. The present value, a.k.a. present worth is defined as the value of a future sum of money or cash flow stream at present, given a rate of return over a specified number of periods. The concept reflects the time value of money, which is the fact that receiving a given sum today is worth more than receiving the same amount in some future date. It is practically compound interest calculation done backwards to find the amount you have to invest now to get to a desired amount in the specified point in the future. It is widely used in finance and stock valuation, although Net Present Value (NPV) is often preferred by experienced experts.

The answers based on the present value formula and are shown in the table below. Money is worth more now than it is later due to the fact that it can be invested to earn a return. (You can learn more about this concept in our time value of money calculator). One way to tell if you’re looking at a future value or present value problem is to look at how many times the interest rate is being applied. In the future value example illustrated above, the interest rate was applied once because the investment was compounded annually.

As long as the NPV of each investment alternative is calculated back to the same point in time, the investor can accurately compare the relative value in today’s terms of each investment. For example, a timeline is shown below for the example above, where we calculated the future value of $10,000 compounded at 12% for 3 years. Similar to future value tables, present value tables are based on the mathematical formula used to determine present value.